Embed this Infographic

<a href="http://online.ndm.edu/news/business/solopreneurs-guide-infographic/"><img style=max-width:"100%";height:"auto"><img src="http://online.ndm.edu/wp-content/uploads/2018/10/Solopreneur-Checklist.jpg"><alt="The Path to Ownership: A Solopreneur’s Guide"><width="1024" border="0">

Start Your Path to Your Solopreneur Career

Now that you see what it takes to start your small business, earn the degree that will help your business become a success. Notre Dame of Maryland University offers a comprehensive online bachelor’s in business degree, giving you the small business fundamentals you need to become a prosperous solopreneur.

View Degree DetailsTranscript: The Path to Ownership: a Solopreneur’s Checklist

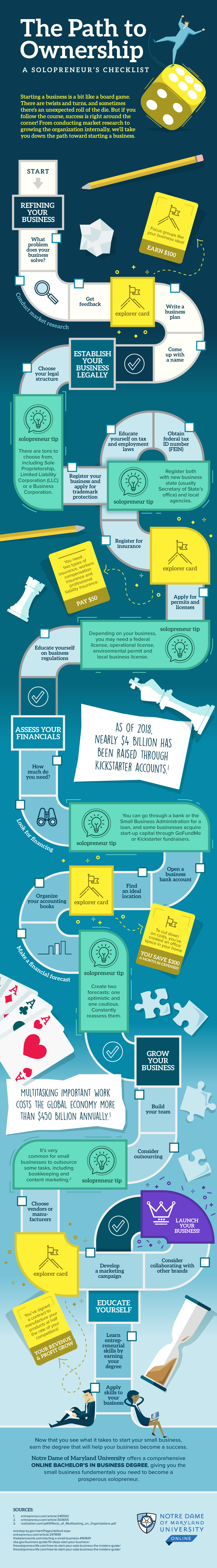

Starting a business is a bit like a board game. There are twists and turns, and sometimes there’s an unexpected roll of the die. But if you follow the path, success is right around the corner! From conducting market research to growing the organization internally, we’ll take you down the path toward starting a business.

Refining Your Business

- What problem does your business solve?

- Conduct market research.

- Get feedback.

- Focus groups like your business idea! Earn $100.

- Write a business plan.

- Come up with a name.

Establish Your Business Legally

- Choose your legal structure.

- Solopreneur Tip: There are tons to choose from, including Sole Proprietorship, Limited Liability Corporation (LLC), or a Business Corporation.

- Register your business and apply for trademark protection.

- Solopreneur Tip: Register both with new business state (usually Secretary of State’s office) and local agencies.

- Obtain federal tax ID number.

- Educate yourself on tax and employment laws.

- Register for insurance.

- Entrepreneur Explorer Card: You need two types of insurance, workers compensation insurance and professional liability insurance. Pay $50.

- Apply for permits and licenses.

- Solopreneur Tip: Depending on your business, you may need a federal license, operational license, environmental permit and local business license.

- Educate yourself on business regulations.

Assess your Financials

- How much do you need?

- Look for financing.

- Solopreneur Tip: You can go through a bank or the Small Business Administration for a loan, and some businesses acquire start-up capital through GoFundMe or Kickstarter fundraisers. As of 2018, nearly $4 billion has been raised through Kickstarter accounts [1].

- Open a business bank account.

- Find an ideal location.

- Entrepreneur Explorer Card: To cut down on costs, you’ve created an office space in your home. Save $300 a month in expenses.

- Organize your accounting books.

- Make a financial forecast.

- Solopreneur Tip: Create two forecasts, one positive and one cautious, and constantly reassess them.

Grow your Business

- Build your team.

- Consider outsourcing.

- Solopreneur Tip: It’s very common for small businesses to outsource some tasks, including bookeeping and content marketing. Multitasking important work costs the global economy more than $450 billion annually. [2]

- Choose vendors or manufacturers.

- Entrepreneur Explorer Card: You’ve signed a contract to manufacture your products at half the rate of your competitors! Your revenues and profit grow.

- Develop marketing campaigns.

- Consider collaborating with other brands.

- Launch your business!

Educate Yourself

- Get your degree.

- Learn entrepreneurial skills.

- Apply skills to your business.

Sources:

- https://onestop.ky.gov/start/Pages/default.aspx

- https://www.entrepreneur.com/article/297899

- https://www.thebalancesmb.com/starting-a-small-business-4161641

- https://www.sba.gov/business-guide/10-steps-start-your-business/

- https://www.entrepreneur.com/article/246592

- http://www.realization.com/pdf/Effects_of_Multitasking_on_Organizations.pdf

Explore Degrees

Explore Degrees Request Info

Request Info Apply Today

Apply Today