Business is full of opportunity, but opportunities often come with risks. Companies must understand how to properly evaluate and prepare for the hazards they face. Any organization, no matter the size, must understand the role of risk management in business so it can either avoid potential risks or minimize the costs associated with those risks.

Read on to discover how you can help spot possible hazards, evaluate them and execute solutions through the risk management process.

What is Risk Management?

Risk management in business consists of identifying potential risks, analyzing the possible outcomes and solutions and putting a plan in place to prepare for or mitigate them. Risk management looks different for each organization because goals, financials and environments differ greatly. Still, using a clear procedure when approaching risk is key for all companies.

Our current business world is filled with risks. Business expert, author and senior contributor at Forbes George Bradt said, “The world is a scary, scary place to do business. There are risks all over the place from unseen hackers to known competitors to weather to regulatory changes to employee theft.”

It’s true that risk is pervasive and comes in many forms. That doesn’t mean companies can’t be ready for it. A risk management process makes all this less frightening and allows companies to be prepared. Some types of risks are easier to protect against than others and not all is undesirable. Risk is a normal part of participating in business and can be assessed and managed like any other part of organizational planning. So, what types of risk should your company be on the lookout for?

Types of Risk

Various types of risk exist in business. Here are some primary categories companies should focus on:

- Strategic Risk: Strategic risk is associated with your industry and business activities. It includes mergers and acquisitions, new competitors and innovations, changes in demand and new research and development.

- Financial Risk: Financial risks have to do with the transactions your company makes, such as providing credit to customers, collecting payment and incurring debts. These risks could also be outside of the company, such as an economic recession.

- Operational Risk: The operational category has to do with the day-to-day administrative operations of your business. These are risks that affect your supply chain, IT systems and staffing. Examples include employee turnover, system outages or problems with shipping.

- Hazard/Physical Risk: Physical hazards include danger to your buildings or equipment, such as fires or natural disasters. They also include risks associated with your employees, such as injury or illness.

The type of risk that you’re dealing with informs how to plan. A process should be employed to help navigate this important realm.

Interested in an online degree in Business?

Prepare to lead your organization through challenges and opportunities with B.A. in Business from Notre Dame of Maryland University.

Explore DegreeThe Risk Management Process

Implementing a risk management process is vital for any organization, no matter the size. Before beginning the risk management process, professionals must have a firm understanding of company objectives and structure. The same risk management plan would not work for any two organizations, as it must be personalized to meet the individual goals of each business.

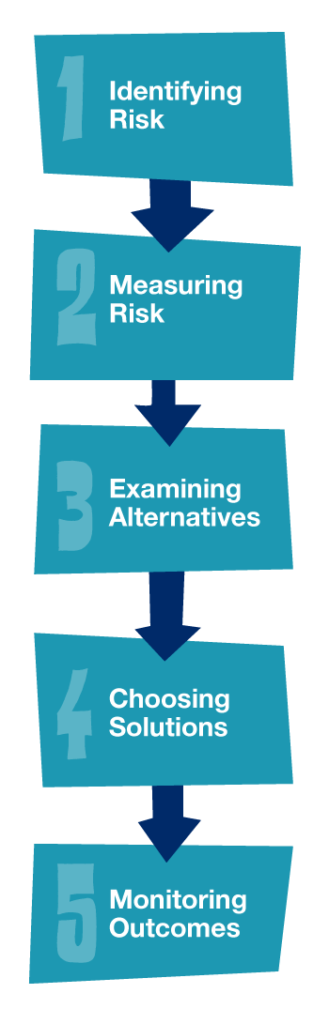

Usually, the risk management process consists of five steps. They include:

1. Identifying Risk

In this stage of the risk management process, you must evaluate the day-to-day activities of the company and the industry to determine what could possibly go wrong. Consider all types of risks, review the company history of loss due to risks and consult with internal and external experts.

The Project Management Institute (PMI) recommends these activities for spotting risks, among others:

- Interviews: Talking to relevant stakeholders to find possible problems

- Assumption Analysis: Making unconscious assumptions visible

- Document Analysis: Going through project documents to find potential risks

- Brainstorming: Get a group together to talk out their thoughts with no fear of judgement

Risk is always changing so this step is not something that can be done once. It’s important to continually identify potential risks to your organization.

2. Measuring Risk

This step includes two important questions:

- How likely is the risk to occur?

- What impact would it have if it did?

You can map the answers to these questions out on a risk map to determine which risks are most pressing. Generally, you would pay attention to managing risks that have a high likelihood of occurring and a big impact more so than you would risks that are rare and have small impacts on the organization.

3. Examining Alternatives

At this stage, you would examine ways to mitigate the risk. You must consider if the cost of mitigating the risk is worth it. Consult your risk map at this stage.

Your organization can choose to:

- Accept: You can choose to call the risk a normal cost of operating a business and decide that the benefits of the activity outweigh the risk.

- Avoid: Your company would not participate in an activity because of the impact of the risk associated.

- Control: You can take steps to prevent the risk or reduce the impact it will have.

- Transfer: Transferring risk usually comes in the form of purchasing an insurance plan, thus moving the risk to another organization.

Examine the impact of each alternative solution associated with the risk so that you can better make a solution decision.

4. Choosing Solutions

Deciding the right course of action includes reviewing financial resources and desired outcomes. It’s important to have board members and other leaders sign off on the solution you choose.

At this stage, your organization’s risk appetite will come into play. A risk appetite is defined as, “The amount and type of risk that an organization is prepared to pursue, retain or take.” Companies with a risk appetite statement can refer to that when determining whether to accept, avoid, control or transfer certain risks.

Once the choice of solution has been made, you must implement a method to put the solution in place across the organization. This is known as your risk management plan. It should be clear, concise, agreed upon and revisited often for any necessary updates and revisions.

5. Monitoring Outcomes

As we mentioned above, the risk management process is never done, and your risk management plan should not be set in stone. Because all businesses are constantly changing, as well as the economic landscape, you should continually review your risk assessments and plans to ensure that everything is still as effective as possible.

Risk management in business is clearly important. Further training can help you identify and prepare for all types of risk within your organization. The online B.A. in Business from Notre Dame of Maryland University offers a diverse curriculum to enhance your risk analysis and business skills. Course topics focus on the latest business practices and theories through case studies, consulting assignments and a capstone course to give real-world knowledge you can apply immediately.

Explore Degrees

Explore Degrees Request Info

Request Info Apply Today

Apply Today